Webulls Trading Platform Guide: Tools, Account Structure & Investor Considerations

Introduction

Digital brokerage platforms have transformed how retail investors access financial markets. Mobile-first design, real-time analytics, and user-controlled execution are now standard expectations. Webulls is often mentioned among modern online trading platforms focused on technology-driven investing.

This article provides an educational overview of webulls, including its interface, trading tools, account structure, and practical considerations for prospective users. The information below is neutral and intended for research purposes only.

What Is Webulls?

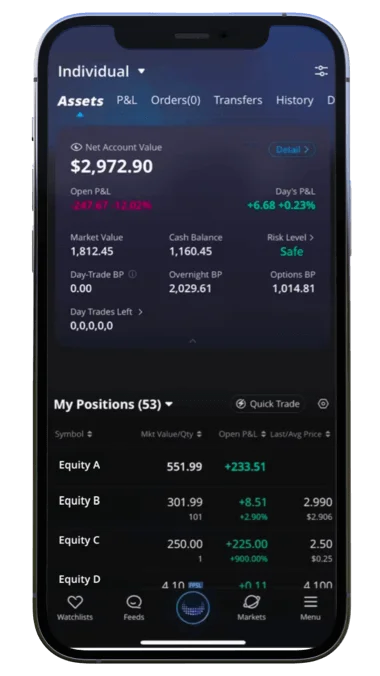

Webull is a digital brokerage service offering self-directed access to financial markets. The platform provides web-based and mobile applications that allow users to trade various instruments and monitor portfolios.

Webulls emphasizes data visualization, technical charting tools, and customizable dashboards to support independent market analysis.

Platform Interface & Market Tools

4

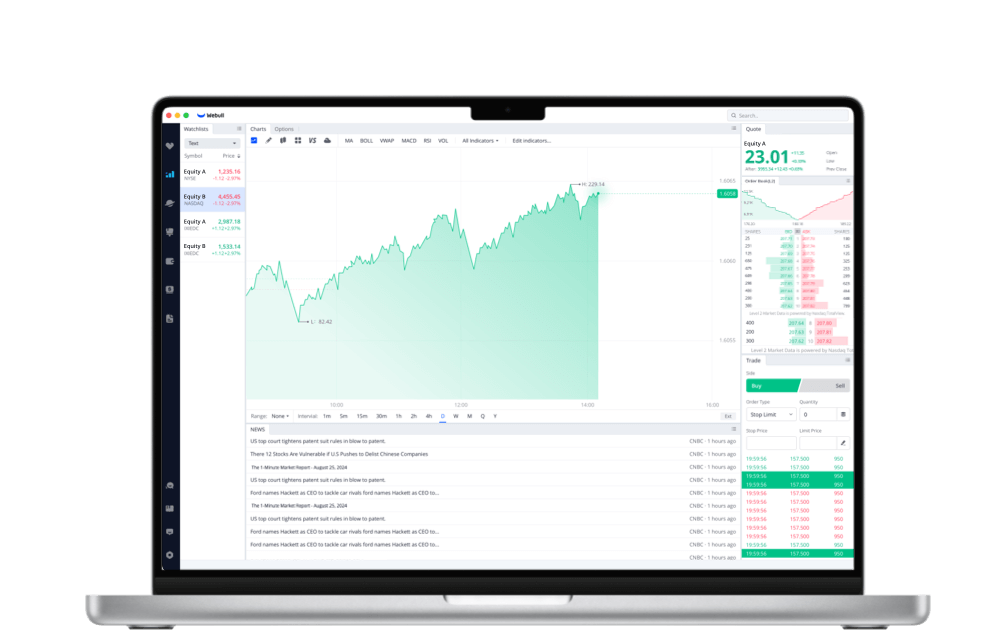

Webulls includes analytical features commonly used by active traders:

- Real-time price charts

- Technical indicators (moving averages, RSI, MACD, etc.)

- Customizable watchlists

- Stock screeners

- Extended-hours trading access (where available)

The platform’s interface is designed for users comfortable with self-directed investing.

Account Setup & Verification

Opening an account on webulls generally involves:

- Online registration

- Identity verification

- Financial suitability assessment

- Agreement to regulatory disclosures

Verification processes are typically required to comply with financial regulations. Users should review official terms before applying.

Available Trading Instruments

Depending on eligibility and region, webulls may offer access to:

- U.S. stocks

- Exchange-traded funds (ETFs)

- Options contracts

- Margin trading (subject to approval)

Availability of specific products may vary by jurisdiction and regulatory framework.

Fee Structure & Costs

Digital brokerage platforms typically outline:

- Commission policies

- Margin interest rates

- Regulatory fees

- Options contract fees

Investors should review the most current fee schedule directly from official sources to understand total transaction costs.

Risk Factors to Consider

All trading activity carries financial risk. Key considerations include:

- Market volatility

- Liquidity risk

- Margin-related exposure

- Regulatory and tax implications

- Platform execution risk

Investors should evaluate personal financial objectives and risk tolerance before trading. Professional advice may be appropriate in certain circumstances.

Security & Data Protection

Webulls generally incorporates security measures such as:

- Multi-factor authentication

- Data encryption protocols

- Account monitoring systems

- Regulatory compliance standards

Users should activate available security features and maintain secure login practices.

Webulls vs Traditional Brokerage Models

| Feature | Traditional Brokerage | Webulls |

|---|---|---|

| Physical Offices | Often available | Digital-only |

| In-Person Advisory | Common | Typically not included |

| Advanced Charting | Varies | Strong emphasis |

| Mobile Optimization | Moderate | High priority |

| Self-Directed Trading | Supported | Primary focus |

Webulls is structured primarily for investors who prefer independent control rather than advisory services.

Who Might Evaluate Webulls?

Webulls may appeal to:

- Tech-oriented investors

- Active traders using chart analysis

- Mobile-first users

- Individuals comfortable managing trades independently

Platform suitability depends on experience level, trading strategy, and regulatory eligibility.

Conclusion

Webulls is a digital brokerage platform offering web and mobile trading access, advanced charting tools, and self-directed portfolio management features. Investors researching webulls should carefully review regulatory disclosures, fee schedules, and risk considerations before opening an account.

This content is for informational purposes only and does not constitute investment advice.