Webulls Platform Overview: Features, Trading Tools & Account Management

Introduction

Online investing platforms have grown significantly in recent years, offering retail investors access to markets through digital interfaces. Webulls is commonly referenced in discussions around modern trading apps and brokerage technology.

This article provides an educational overview of webulls, including its general structure, platform tools, account access, and considerations for users evaluating online brokerage services. The content is informational and does not constitute financial advice.

What Is Webulls?

Webull is a digital brokerage platform that provides access to stocks, ETFs, options, and other financial instruments through web and mobile interfaces.

The platform focuses on technology-driven trading tools, data visualization, and user-controlled portfolio management. Webulls is typically used by self-directed investors who prefer managing trades through online dashboards.

Platform Interface & Tools

4

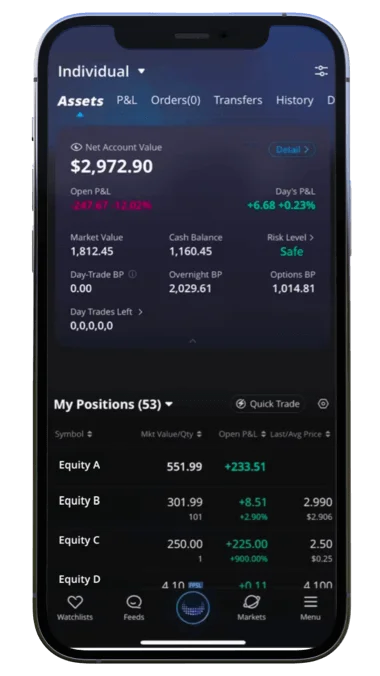

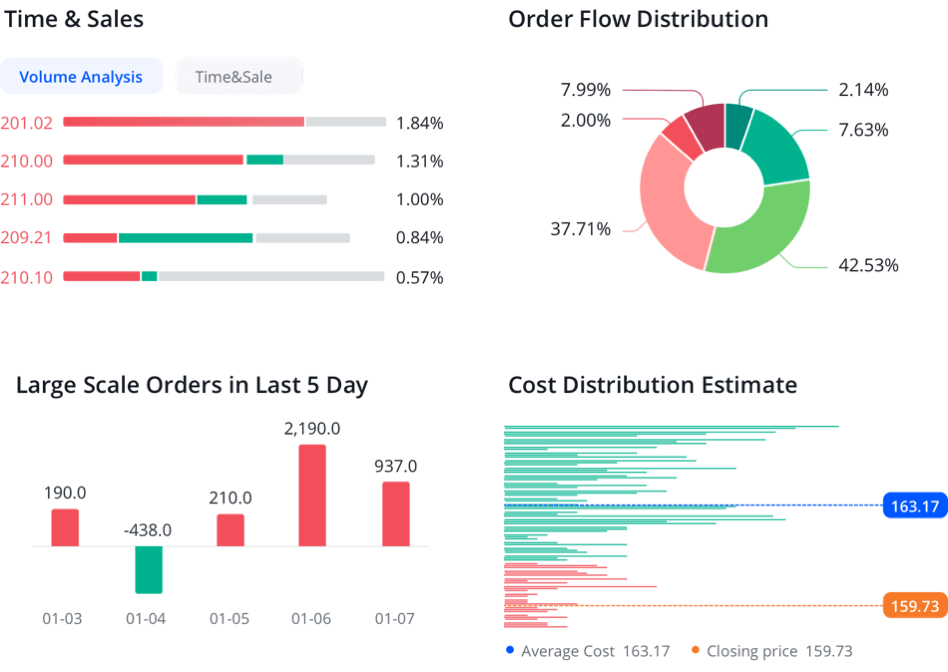

Webulls offers both desktop and mobile trading environments. Core features often include:

- Real-time market data

- Customizable charting tools

- Technical indicators

- Watchlists

- Portfolio tracking dashboards

The platform emphasizes analytics and visual chart tools to support self-directed research.

Account Types & Access

Webulls typically supports:

- Individual brokerage accounts

- Margin accounts (subject to eligibility)

- Retirement account options (depending on region)

Account verification generally requires identity confirmation in accordance with regulatory standards. Users should review eligibility requirements before applying.

Trading Instruments

Webulls users may access various financial instruments, such as:

- U.S.-listed stocks

- Exchange-traded funds (ETFs)

- Options contracts

- Extended-hours trading (where applicable)

Instrument availability may vary by region and regulatory approval.

Risk Considerations

Online trading platforms involve financial risk. Users should consider:

- Market volatility

- Margin risks (if applicable)

- Liquidity factors

- Regulatory rules

- Tax implications

Investing decisions should be based on personal financial circumstances and independent research. Consulting licensed financial professionals is recommended when appropriate.

Security & Compliance

Digital brokerage platforms must follow regulatory standards. Webulls generally implements:

- Multi-factor authentication

- Data encryption

- Regulatory compliance measures

- Account monitoring systems

Users should always enable available security features and review official documentation.

Advantages of Webulls Platform

Commonly cited strengths include:

- Modern trading interface

- Advanced charting tools

- Mobile accessibility

- Extended-hours access (where available)

- Transparent fee structure (subject to platform terms)

However, platform suitability depends on individual trading experience and goals.

Webulls vs Traditional Brokerage Firms

| Feature | Traditional Broker | Webulls |

|---|---|---|

| Branch Offices | Yes | No (digital) |

| Mobile Trading | Limited | Strong focus |

| Advanced Charting | Varies | Integrated |

| Self-Directed Tools | Moderate | Extensive |

| In-Person Advisory | Often available | Typically not included |

Webulls is primarily structured for self-managed investing rather than advisory services.

Who May Consider Webulls?

Webulls may be suitable for:

- Self-directed retail investors

- Traders who use technical analysis

- Mobile-first users

- Investors seeking digital access to U.S. markets

Each investor should evaluate platform features, regulatory standing, and personal risk tolerance.

Conclusion

Webulls represents a technology-driven brokerage platform offering digital trading tools and market access through web and mobile applications. Investors researching webulls should review official documentation, regulatory disclosures, and fee structures before opening an account.

This article is intended for educational purposes and does not constitute financial or investment advice.