Webulls Online Brokerage Guide: Platform Features, Execution Model & Investor Awareness

Introduction

The rise of digital investing platforms has reshaped how individuals access global markets. Modern brokerage systems prioritize speed, mobile access, and advanced charting tools. Webulls is frequently discussed as a technology-focused trading platform built for self-directed investors.

This article provides a structured, research-oriented overview of webulls, explaining its platform design, trading functionality, regulatory framework, and practical considerations for users. The information below is educational and does not constitute investment advice.

What Is Webulls?

Webull operates as a digital brokerage platform that allows individuals to trade financial instruments through web and mobile interfaces. The platform focuses on analytical tools, customizable dashboards, and independent execution.

Webulls is generally positioned for users who prefer managing trades themselves rather than relying on traditional advisory services.

Platform Technology & User Interface

4

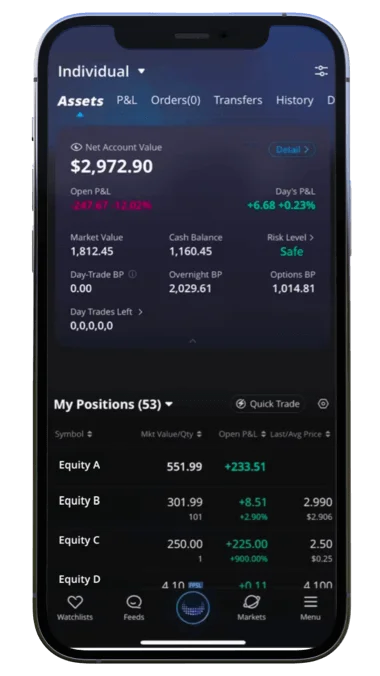

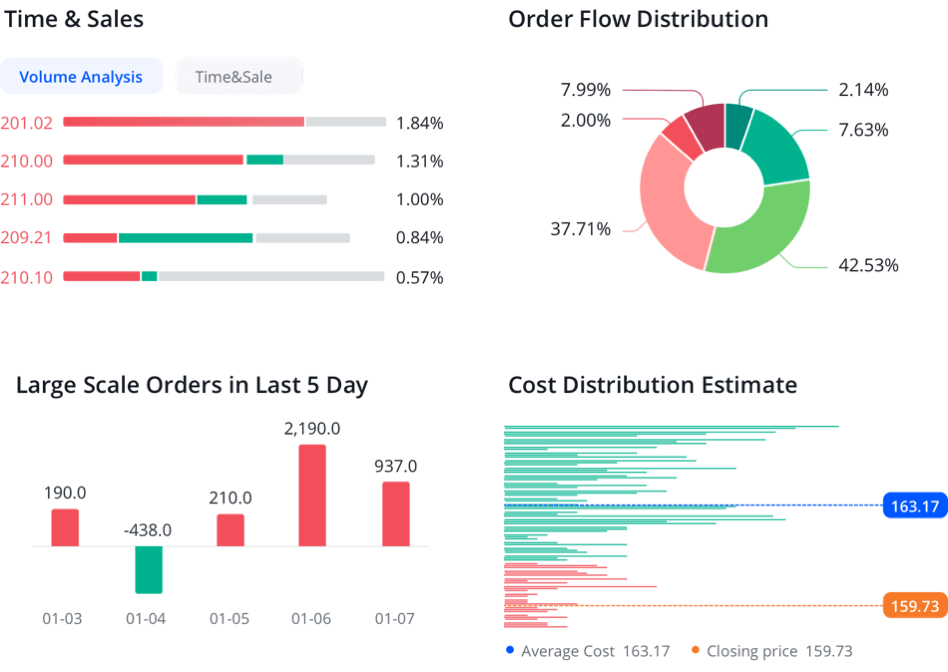

The webulls interface typically includes:

- Advanced charting systems

- Technical indicators and overlays

- Real-time price feeds

- Custom watchlists and alerts

- Portfolio analytics

These features are commonly used by traders who rely on data-driven decision-making.

Account Opening Process

To open a webulls account, users generally complete:

- Online registration

- Identity verification (KYC compliance)

- Financial profile disclosure

- Agreement to brokerage terms and risk disclosures

These procedures are designed to meet regulatory standards and protect market integrity.

Depending on eligibility, account types may include:

- Individual brokerage accounts

- Margin accounts (subject to approval)

- Retirement-oriented accounts (if supported)

Market Access & Tradable Instruments

Webulls may provide access to:

- U.S.-listed stocks

- Exchange-traded funds (ETFs)

- Options contracts

- Extended-hours trading sessions

Product availability can vary depending on jurisdiction and regulatory approvals.

Order Execution & Control

Digital brokerage platforms like webulls allow users to:

- Place market and limit orders

- Monitor order status in real time

- Adjust positions directly through the interface

Execution speed and routing depend on market conditions and brokerage infrastructure.

Fees & Cost Awareness

Brokerage platforms typically outline:

- Commission policies

- Options contract fees

- Margin interest rates

- Regulatory transaction charges

Prospective users should consult official fee schedules to understand total trading costs.

Risk Considerations

Investing involves financial risk. Users of webulls should consider:

- Market volatility

- Liquidity conditions

- Margin-related leverage exposure

- Tax implications

- Regulatory changes

Investment decisions should align with individual financial objectives and risk tolerance.

Security & Data Protection

Webulls generally incorporates industry-standard security measures such as:

- Multi-factor authentication

- Encrypted data transmission

- Account monitoring systems

- Regulatory compliance procedures

Users are encouraged to enable all security features available within the platform.

Webulls vs Traditional Brokerage Firms

| Feature | Traditional Brokerage | Webulls |

|---|---|---|

| Physical Locations | Often available | Digital-only |

| Advisory Services | Frequently included | Primarily self-directed |

| Advanced Charting | Varies | Integrated |

| Mobile Focus | Moderate | Strong |

| User Execution Control | Shared with advisor | Direct user control |

Webulls is structured primarily for independent, technology-oriented investors.

Who May Consider Webulls?

Webulls may appeal to:

- Active traders

- Technical analysis users

- Mobile-first investors

- Individuals comfortable with independent decision-making

Suitability depends on experience level and financial goals.

Conclusion

Webulls is a digital brokerage platform offering web and mobile trading access, advanced charting tools, and self-directed portfolio management features. Individuals researching webulls should review official disclosures, fee structures, and regulatory documentation before opening an account.

This article is provided for informational purposes only and does not constitute financial advice.