Webulls Trading Ecosystem: Platform Capabilities, Account Controls & Regulatory Overview

Introduction

Retail investing has increasingly shifted toward mobile-first and web-based brokerage systems. Investors today expect intuitive dashboards, analytical charting, and streamlined execution within secure digital environments. Webulls is often discussed among technology-driven brokerage platforms built for self-directed users.

This article offers a structured, neutral overview of webulls, its operational framework, available trading tools, compliance structure, and practical considerations for individuals evaluating online brokerage services. This content is informational and not financial advice.

What Is Webulls?

Webull is a digital brokerage service providing access to financial markets through web and mobile applications. The platform focuses on user-controlled trading, data visualization, and analytical features.

Webulls is designed for individuals who prefer to manage trades independently rather than through in-person advisory services.

Platform Interface & Analytical Features

4

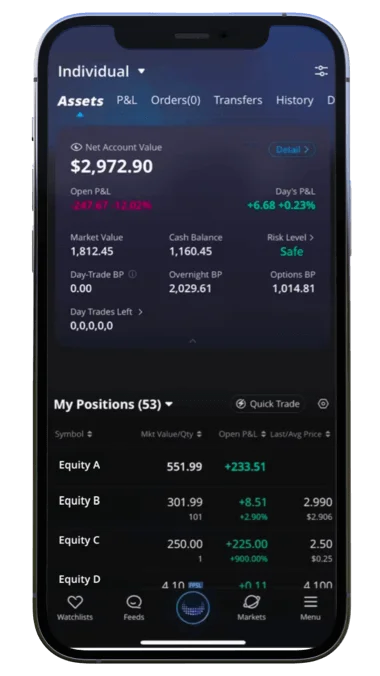

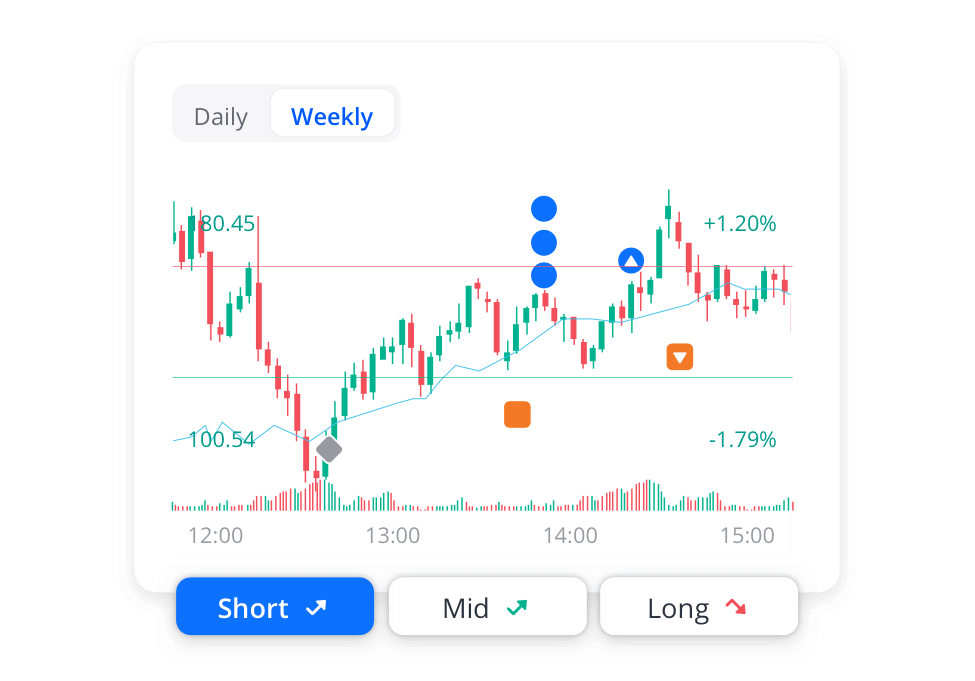

The webulls interface typically includes:

- Interactive price charts

- Multiple technical indicators

- Stock and ETF screeners

- Watchlists with alerts

- Portfolio performance summaries

These tools support research-based decision-making for active market participants.

Account Registration & Verification

Opening a webulls account generally involves:

- Completing an online application

- Submitting identity verification documents

- Providing financial suitability information

- Reviewing and accepting brokerage agreements

Verification requirements are intended to comply with regulatory standards.

Available account types may include:

- Individual brokerage accounts

- Margin accounts (subject to approval)

- Retirement-focused accounts (where supported)

Eligibility depends on region and regulatory rules.

Trading Instruments & Market Access

Webulls may provide access to:

- U.S.-listed equities

- Exchange-traded funds (ETFs)

- Options contracts

- Extended-hours trading (pre-market and after-hours sessions)

Instrument availability varies by jurisdiction.

Fee Considerations

Digital brokerage platforms typically disclose:

- Commission policies

- Options contract charges

- Margin interest rates

- Regulatory transaction fees

Prospective users should review official fee schedules to understand total trading costs.

Risk & Market Volatility

Trading and investing carry inherent financial risk. Considerations include:

- Market price fluctuations

- Liquidity conditions

- Margin-related leverage exposure

- Regulatory and tax implications

Investors should align trading activity with their financial objectives and risk tolerance. Consulting qualified professionals may be appropriate.

Security Measures

Webulls generally implements industry-standard protections such as:

- Multi-factor authentication

- Data encryption

- Secure login protocols

- Account activity monitoring

Users should activate all available security features and follow best practices for account protection.

Webulls Compared to Conventional Brokerage Firms

| Feature | Conventional Broker | Webulls |

|---|---|---|

| Physical Branches | Often available | Digital-only |

| Advisory Services | Common | Primarily self-directed |

| Advanced Charting | Varies | Integrated |

| Mobile Optimization | Moderate | Strong emphasis |

| User-Controlled Execution | Available | Core focus |

Webulls emphasizes digital access and independent trading rather than advisory relationships.

Who Might Consider Webulls?

Webulls may be evaluated by:

- Active traders

- Technical-analysis-focused investors

- Mobile-first users

- Individuals comfortable with independent trade execution

Suitability depends on experience level and financial goals.

Conclusion

Webulls is a digital brokerage platform offering web and mobile market access, analytical charting tools, and user-controlled execution features. Individuals researching webulls should carefully review official documentation, regulatory disclosures, and fee structures before opening an account.

This article is intended for educational purposes only and does not constitute financial advice.